A Permanent Account Number, or PAN, is used to identify different taxpayers within the country. Pan Card is a unique 10-digit identification alphanumeric number that contains both numbers and alphabets. It is assigned to Indians who are mostly taxpayers.

PAN is an Indian computer-based system that assigns a unique identification number to each taxpayer entity. This method records all tax-related information about a person against one PAN number, which is the primary storage key. This PAN number is shared throughout the country so that no two taxpayer entities can have the same PAN.

The Income Tax Department also issues PAN Cards to entities when PAN is assigned. PAN is a number. However, a PAN Card, which is a physical card, contains your PAN, name, date-of-birth (DoB), spouse’s name, and photographs. You can submit a copy of this card as proof of identity.

Because it is not affected by any address change, your PAN card is valid for life.

Why is PAN important? The Benefits and Uses of a PAN Card

PAN Card is essential for taxpayers because it is required for all financial transactions. It is also used to track your money’s inflow and outflow. It is essential when you pay income tax, receive tax refunds, or receive communication from the Income Tax Department.

Individuals without a PAN are allowed to use their Aadhaar number for filing returns and other purposes where PAN was previously mandatory. If you do not link your pan with an Aadhar or have not yet created one, you can use your Aadhaar number to file returns and for any other purpose where PAN is mandatory. However, the rules about this are still in the creation/updation/approval process.

PAN Card is still required for any monetary transactions. PAN Card can also be used to prove identity. Below are some benefits and uses of a PAN Card:

- Open your bank account easily: Every bank and financial institution requires a PAN card to open a savings or current bank account.

- There is no barrier to business transactions: The Government has made the PAN card mandatory for all companies, as per the amendment to the Income Tax Act 1961.

- Get your IT Rebates and Refunds: If the TDS amount exceeds what you have to pay, you might be eligible for a refund. Only if you have filed your income tax return and your TDS deduction is linked to PAN can you get the IT department refunds.

- TDS Rebate for Saving Deposits: If the annual interest earned by your savings account is greater than INR 10,000/-, then the TDS deduction will only be 10% if you are a PAN card Holder. Otherwise, the TDS deduction would be 20%.

- Opening a Demat account: PAN card is required to open a dematerialized (also known as Demat) account. This account allows you to keep all of your securities and shares in electronic or dematerialized format.

- Loan facility: Banks or Financial Institutions do not offer any loan or credit facility to anyone without a valid PAN card.

- Buying and selling property: You will need your PAN card details to buy or sell immovable property worth more than INR 10 Lakhs.

Who should get PAN? – PAN Card Eligibility

The Income Tax Act Section 139A requires the following taxpaying entities to have a permanent account number:

- Anyone who has or will pay tax to the Income Tax Department. The tax levels will determine this.

- A person with a business or professional practice generates more than Rs.5 million in a given year.

- Exporters and importers that are subject to any tax or duty charge as per the Income Tax Act, or any other applicable law

- There are many types of trusts, charities, and associations.

All taxpaying entities, including individuals, minors, HUFs and partnerships, corporations, bodies of individuals, trusts, and others, should apply for PAN.

How to apply for a PAN card

Application for a PAN Card can be made online at one of these websites:

- Protean of Technologies Limited (formerly NSDL). www.onlineservices.nsdl.com/

- UTIITSL https://www.utiitsl.com/

You can also apply offline to any of the PAN agencies at the district level. You can apply online for a Pan Card and make corrections or changes to your information. You can request a duplicate Pan Card if you have lost the original.

Indian citizens and NRIs are required to apply for a new PAN. This includes companies, NGOs or partnership firms, local bodies, trusts, and other entities. Form 49A must be completed. Form 49A is required for foreigners and foreign entities. These forms should be submitted with all required PAN documents to the Income Tax PAN Services Unit.

You can track the status and application for a PAN replacement or duplicate by using the acknowledgment number.

According to the Protean of Technologies Limited website, printing and sending cards takes around 2 weeks or 14 working days.

How you can Apply PAN Card Offline

Below are the steps to take if you want to apply offline for a PAN Card

Step 1: Visit TIN-Protein of Technologies Limited (formerly NSDL) by clicking on the link https://www.tin-nsdl.com/.

Step 2: On the main page, in the “Downloads” section, click on “PAN“. This will take you to a new page.

Step 3: Click on ‘Form 49A‘.

Step 4: The Form 49A application form will be displayed on your computer’s screen in pdf format print the form by downloading it.

Step 5: Fill out the form and verify that all details are correct.

Step 6: Make sure to attach all necessary documents, including a passport-sized photograph.

Step 7: You will need to pay the registration fee. This can be made via demand draft payable at Mumbai in favor of ‘Protein of Technologies Limited – PAN’. You will need to pay Rs.115.90.

Step 8: Attach the application form and photocopies of all documents to an envelope. Make sure you mention ‘APPLICATION FOR

PAN-N-Acknowledgement Number’ on the envelope and send it to the address.

Income Tax PAN Services Unit Protean of Technologies Limited e-Governance Infrastructure Limited 5th Floor, Mantri Sterling Plot No. Survey No. 341, 997/8 Model Colony. Near Deep Bungalow Chowk. Pune – 411016.

An application number will be issued to you, which you can use for tracking the status of your PAN Card applications.

Documents Lists required to apply for a PAN Card

You must submit several documents to be eligible for a PAN Card. Below is a list of documents you must submit when applying for a Pan Card.

If you are an individual applicant

- Aadhaar, VoterID, and Driving License are all examples of proof of identity.

- Documents that prove your address, such as utility bills, water bills, statements from bank accounts, credit cards, Passport, Driving License, Driving License, Domicile certificate issued to the Government, a certificate proving marriage, enrollment, etc.

You are a member of a Hindu Undivided Family.

- The Karta must submit an affidavit at the HUF. You must clearly state each coparcener’s father’s name, address, and name in your affidavit.

- If you are a HUF member and are applying individually for a Pan Card, you will need to provide proof of identity, address, and date of birth.

Companies registered in India

- You must submit a copy of the Registration Certificate to the Registrar of Companies.

Limited Liability Partnerships and Firms are registered in India

- You must submit a copy of the Registration Certificate to the Registrar of Companies.

- You must submit a copy of the Partnership Deed.

Trusts registered or formed in India

- A copy of the Charity Commissioner’s Registration Certificate Number will be required.

For Association of Persons

- The Registrar of Co-operative Societies or Charity Commissioner issues an Agreement Copy or Registration number Certificate. Any document issued by the Central or State Government identifies your address or identity.

Non-Indian Citizens of India

- Copy of PIO issued from the Government of India or Copy of OCI issued to the Government of India. Passport Copy.

- You can use the following to prove your address: a bank statement from the residence country, an NRE Bank statement or a copy of a VISA issued by an Indian company. A registration certificate issued in FRO may also be acceptable.

How to get a duplicate PAN card if your original one has been lost

If you have lost your original PAN card, you must follow these steps to get a duplicate.

- To apply for a duplicate of your PAN Card, visit the TIN-Protean of Technologies Limited website (formerly NSDL). https://www.onlineservices.nsdl.com/

- For Indian citizens, you must submit Form 49A. If you are from abroad, you will need to submit Form 49A.

- You must make the required payment to apply for a duplicate PAN card. You can also pay via demand draft.

- Send the form that you have filled out to the following address: Income Tax PAN Services Unit Protean of Technologies Limited e-Governance Infrastructure Limited 5th Floor Mantri Sterling, Plot No. 341, Survey No. 997/8 Model Colony. Near Deep Bungalow Chowk. Pune – 411 016.

- Your duplicate PAN card will be delivered to you in approximately 45 days.

PAN card Online Status Check/PAN Card Tracking/ Enquiry/PAN Card Tracking

- After applying, you can check online the status of your PAN Card.

- You can see the status of your application to find out if the card is issued or in transit.

- The status of your application for a PAN card can be checked on the TIN-Protean of Technologies Limited website or the UTIITSL site. https://www.utiitsl.com/

- With your name and birth date, you can check the status of your PAN Card Application.

Who issues the PAN card?

The Income Tax Department issues the PAN Card with assistance from authorized district-level PAN agents, UTIITSL [UTI Infrastructure Technology and Services Limited], and Protean of Technologies Limited (formerly National Securities Depository Limited -NSDL) https://www.onlineservices.nsdl.com/. Protean of Technologies Limited has several TIN-Facilitation Centers and PAN centers in the country that can help citizens obtain their PAN Cards.

PAN issuing follows the PPP (Public-Private Partnership). This is to preserve the economy, efficiency, and effectiveness and maintain the management, processing, issuing, and issuing of PAN applications.

Types of PAN cards

PAN cards can be issued to taxpaying entities. The types are based on this.

- Indian Citizenship Card

- Indian Companies: PAN Card

- PAN for Foreign Citizens

- PAN for Foreign Companies

Individual PAN Cards have the individual’s photograph, date and father of birth, signature, hologram, QR Code, issue date, permanent account number, and date of issue. The company name, date of registration, PAN number, hologram and QR code, and date of issue of PAN, are all included on PAN cards. It won’t have a signature or a photo.

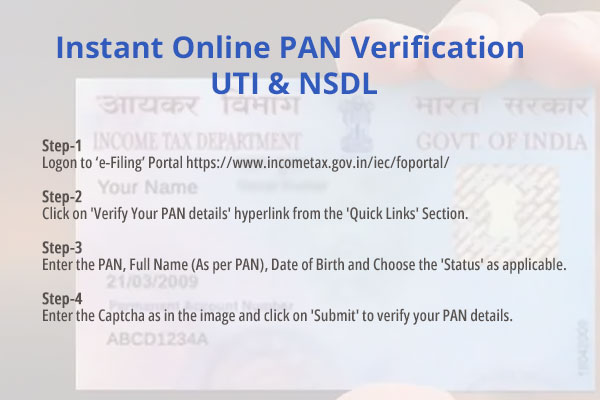

PAN Verification

- Online verification of a PAN Card is an easy and mandatory procedure that can be completed online.

- The online verification of a PAN Card is available on certain government websites.

- Once the details are submitted, the process can be completed.

- The Income Tax Department authorized Technologies Limited e-Governance Infrastructure Limited protean to provide PAN card verification services to eligible entities.

- Online verification of PAN cards is possible with the e-Governance service.

Online PAN Verification of Different Types

- Verification of File-Based PAN Card

2. Organizations or governments can verify up to 1000 PAN Cards simultaneously.

- After logging in, the user can upload up to 1000 PAN Cards to an account in the same file structure as the Protean of Technologies Limited website.

- Once the file has been uploaded, click on “submit“.

- Within 24 hours, the PAN card details will be displayed on the website.

- The website may reject a request if the user doesn’t follow the uploading instructions.

3. Screen-Based Verification of PAN Cards

4. Screen-Based verification allows you to verify up to five PAN cards at once by using the service.

- Log in to your account.

- Log in and add 5 PAN card details to be verified. Add the numbers to your screen.

- After clicking on “submit”, the details of your PAN will appear on the screen.

5. Software-based PAN card verification

6. You can verify your PAN online using a software program.

PAN Verification with PAN Number

You can also verify your Pan with only your PAN number using the following steps:

Step 1: Visit https://eportal.incometax.gov.in/iec/foservices/#/pre-login/verify YourPAN.

Step 2: Fill in your details, including your full name, birth date, mobile number, and PAN number.

Step 3: Click on “Continue“

Step 4: Enter the OTP sent to your mobile phone number and click on “Validate“.

Step 5 Follow the steps on this page to complete the process.

How do you verify the PAN card issued by the company?

- UTI Infrastructure Technology and Services Limited rank among India’s top financial service companies. They are owned and operated by the Government of India. UTIITSL, like NDSL, provides PAN cards to the Indian population that can be applied through their website.

- To verify your identity, visit the UTIITSL PAN website. Log in using your credentials. After logging in, you can select the option to verify the PAN card. The results will be displayed on the website.

Section 194N: Verification of Applicability

Below are the steps required to verify Applicability as per Section 194N.

Step 1: Visit https://www.incometax.gov.in/iec/foportal.

Step 2: Click the ‘TDS on Cash Withdrawal‘ button.

Step 3: Enter the PAN number and mobile number‘.

Step 4: Agree with the declaration and click on “Continue“

Step 5: Enter the OTP sent to your registered mobile phone number and click on “Continue“.

Step 6: The deductible percentage of TDS will appear.

e-Verify Returns via Aadhaar

The ITR must be uploaded to the official Income Tax eFiling website to verify the returns via Aadhaar. After uploading the returns, you’ll need to select the verification type. Select the option to send an Aadhaar OTP to your registered mobile number. After the OTP is entered, you can verify the returns.

PAN Verification Eligibility

Below is a list listing all individuals and groups eligible for PAN verification. The following entities are eligible to use the PAN verification facility:

- RBI approves payment banks

- Central Vigilance Commission

- Stamp and Registration Department

- Reserve Bank of India

- Income Tax Projects

- Agency of the State and Central Government

- Depositories

- Goods and Service Tax Network

- Clearing Corporations/Commodity Exchanges/Stock Exchanges

- Entities that are required to provide Statement of Financial Transaction/Annual Info Return

- Companies are required to produce a Statement of Financial Transaction/Annual Return.

- Educational Institutions established by Regulatory Bodies

- Central KYC Registry

- RBI approves credit information agencies

- Participants in the Depository

- The authorities issue the DSC

- National Pension System’s Central Recordkeeping Agency

- Institutions that issue credit cards

- Mutual Funds

- Insurance Repository

- Insurance Company

- Housing Finance Companies

- RBI approves Prepaid Payment Instrument Issuers

- RBI approves NBFCs

- SEBI Investment Advisor

Register Online for PAN Verification

- Information about how to pay for the Online Pan Card Verification

- Modal payment

- To be paid

- Number of the instrument

2. Organizational details required to register for online PAN number verification

- Name of the entity

- Category of the entity

- TAN/PAN

- Contact details

- Additional personal details

3. Digital Signature Certificate details are required to register for PAN Verification.

- Digital Signature Certificate Class

- Name of the certifying body

- Serial Number for Digital Signature Certificate

Documents required for online PAN verification

Below is a list of documents you must submit:

- A letter of authorization on company letterhead.

- The terms and conditions are printed on the company letterhead.

- Copy of the entity’s PAN Card copy. You must submit two copies and have them signed by an authorized entity.

- Declaration of Entities. You must submit two copies and have them signed by an authorized entity.

- Certificate of incorporation. You must submit two copies and have them signed by an authorized entity.

- The regulatory body has issued a license/certificate copy. You must submit two copies and have them signed by an authorized entity.

- For applicable charges, you can pay by cheque or demand draft. Protean of Technologies Limited – TIN must receive the cheque or demand draft..

Monitoring the Status of Registration

A registered organization can verify its status online by using the acknowledgment number. A message indicating the success of the registration will be displayed along with the User ID. If it is rejected, a message will be displayed to indicate that.

Authorization for Registration

The Income Tax Department must approve the registration of an entity to verify PAN online. Protean of Technologies Limited egov will forward the registration request to the Income Tax Department once the applicant has registered for the facility. This is provided that the applicant completed all forms, submitted the correct documents, and made a successful payment. After authorization, the applicant will receive an 8-digit User ID. The registration fees will be refunded if the Income Tax Department rejects a request to register.

FAQs About PAN Verification

How can an entity renew its PAN verification device?

Yes. An entity can renew its PAN verification online. To do this, log in to the official website using the user ID and digital signature. Next, the entity must choose the “Renewal of Facility” option and click “Submit“.

Do I have to provide my full name to verify my PAN?

You will need to provide your first, middle, and last names for verification purposes.

How can I find my PAN?

Yes. You can visit the official website of the Department of Income Tax, Government of India, and click on the section now your PAN ‘. You will need to enter your status (if applicable) – whether you are an individual or a Hindu Undivided Family, company, government, association of persons, etc. surname, middle and first names, gender, date, birth, mobile number, and gender. You will receive the details once you click ‘Submit‘.

Is there a Swachh Bharat Cess (SBC) for PAN verification?

Yes, Swachh Bharat Cess will be available at 0.5%. All types of verification will require you to pay Rs.60

Do I have to pay an initial deposit for PAN verification?

An initial deposit will be required to confirm your wishes.

How can I access this facility?

This facility is only available to entities registered at the Protean of Technologies Limited eGov website. After that, they will need to submit details about their organization, digital signature certificate, and payment. Other than these, entities must submit documents such as an authorization letter, terms & conditions on company letterhead, copy or certificate from the regulatory body (if applicable), incorporation Certificate, demand draft/ cheque for applicable fees to ‘Protean eGov Technologies Limited – TIN‘. After the authorities have received the fees and documents, the application will be forwarded to the Income Tax Department. After approval, an ID is issued to the registered entity. This allows online verification of PAN.

Does anyone know of a software/solution to verify bulk PANs?

Yes, you can use software to verify bulk PAN numbers. It is listed as one of three verification methods on the Protean of Technologies Limited website. Software (API-based PAN Verification) is the name of this facility. It allows users to verify their Permanent Account Number (PAN) online.

Track the status of your registration for online PAN verification.

Anyone attempting to register online for PAN verification can check their registration status using the acknowledgment number provided. A message indicating the success of the registration will appear on the screen, along with the user ID. A message is displayed if the registration is declined.

How much does it cost to register for online PAN verification?

All three verification methods are subject to online PAN verification. Each method’s annual registration fees are Rs.1200, excluding Goods & Service Tax (GST).

How long can I use this facility?

It can be used for one year after you have registered online for PAN verification.