Introduction

EPF or Employees’ Provident Fund in India deduction by which salaried professional or employee does not get full salary in hand. Well, still there is lots of confusion regarding this deduction.

Why this deduction? What if I don’t want to pay? Where the deducted amount gets accumulated?

So, today we will give you detailed information about this along with the ways for EPF balance check through mobile.

What is EPF in India?

Employee’s Provident Fund is a retirement benefit that is implemented for all salaried employees.

It is kept up by the Employees Provident Fund Organization of India. The company or an enlisted organization with more than 20 workers is ordered by law to enroll with the EPFO.

Actually, it is a decent reserve funds stage that helps representatives in sparing a small amount of their compensation consistently.

This sum can be utilized if you are rendered unfit to work, or upon retirement. One of the best things about this fund is that it also has an equal part of the employer.

What are the Reasons for the Provident Fund from Salary?

From the minute you begin working or any other salaried professional, The company or the employers and employees both begin contributing 12% of the fundamental compensation into your EPF account.

The total 12% of your commitment goes into your EPF account alongside 3.67% (out of 12%) from your manager.

The staying 8.33% goes from your manager’s side and is redirected to your Employee’s Pension Scheme.

EPF is basic to take note of that if your fundamental compensation is above Rs. 7,000 every month, at that point your boss can just contribute 8.33% of 7,000 to your EPS and the parity sum gets credited to your EPF account.

But, those workers who are earning or gaining more than Rs. 15,000 every month can decide on the enrollment of the provident store.

Must Read: HDFC MFOnline – Latest Information That You Should Not Miss

Why EPF or Employee’s Provident Fund is valuable?

This is valuable on the grounds that these assets are pooled together from numerous representatives and contributed by a trust.

This pool creates an enthusiasm of 8% – 12%, as dictated by the legislature and the focal leading body of trustees.

The present yearly financing cost on the authority EPF India site is 8.55% for the year 2017-18.

What tax benefit you can get?

The sum or amount you get when your EPF develops is charge excluded just that you have five years of nonstop service in an organization.

Should you switch occupations inside this time, you can keep away from the assessment by exchanging your current EPF record with your new manager.

In the case of joblessness, your interest in EPF for that specific period is assessable.

What is the eligibility?

Employees’ Provident Fund is represented by the Employees’ Provident Fund Organization and is offered to salaried people. This is required reserve fund conspire that is material to representatives of an organization with in excess of 20 workers or for representatives whose compensation is over the base sum stipulated.

Must Read: Know the Significance of Virtual Debit Card

What is the interest rate?

The interest rate of EPFO has different as every year the EPFO declared the interest rate such as for the last quarter of 2018-2019, the rate of the EPF is continued at 8 %. And for 2017-18 it was declared at 8. 55 %.

What when do not want to Pay?

You cannot opt-out from the middle part of the EPF plan. When you just started your career only at that time you can ask your employer that you don’t want to pay for this.

For this, you have to fill the form 11. Remember once you’ve contributed towards EPF even once and have a record made in your name, you can’t quit this plan.

Try not to stress however, as, despite the fact that quitting the EPF plot expands your close by compensation, it’s the least demanding approach to fabricate a retirement subsidize.

Having somewhat less spending force presently could mean budgetary soundness later.

Different EPF Forms:

The knowledge of EPF forms is very important because this will help you in different places. It undertakes all the happening of EP such as transfer of PF, registration, withdrawal, etc.

Page of Contents

So, Here have a look at the form Details:

| EPF Form | Use of the EPF Form |

| Form 31 | EPF Withdrawal |

| Form 14 | Buying LIC Policy |

| Form 10D | For claiming monthly pension |

| Form 10C | For claiming withdrawal benefits/scheme certificate of EPS |

| Form 11 | EPF Account Transfer |

| Form 19 | Final Employees’ Provident Fund Settlement |

| Form 20 | EPF Final settlement in case of death of the employee |

| Form 2 | Declaration and nomination form for EPF & EPS |

| Form 5 IF | Claim as per EDLI scheme |

| Form 15G | To save TDS on the interest income on EPF |

| Form 5 | New employees registering for EPF and EPS |

| Form 11 | Auto transfer of EPF |

Must Read: Top 7 Mobile Phone Insurance Given By Indian Companies

Check Your EPF Balance Online: Follow the Steps

There are many ways to check the EPF mobile balance because now the technology has whole power that you can access the entire thing on your phone.

You can get details through missed calls, SMS, app and Portal. So, below are the processes that will give you an insight into using the different options.

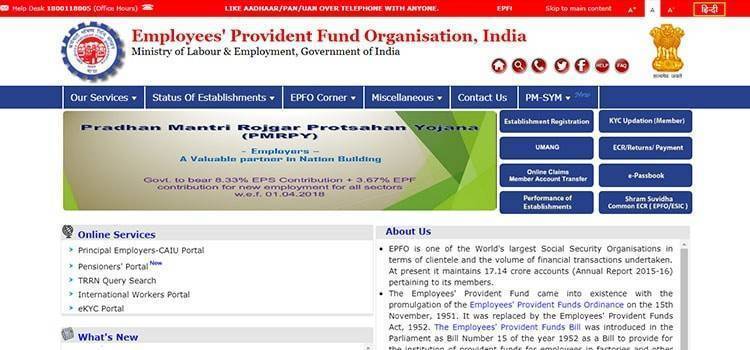

Mode 1st: Check Using EPFO Portal

Things to know: In order to check the EPF balance you have to ensure that the employer has done with the registration of your (UAN) or Universal Account Number.

UAN is a unique number for the employee who has enrolled under the scheme of EPF. This number is given by the EPFO or Employee Provident Fund Organization.

This is the mandatory thing which you will get from the organization and it is only given by once. After your UAN number got activated just go through the below-mentioned steps:

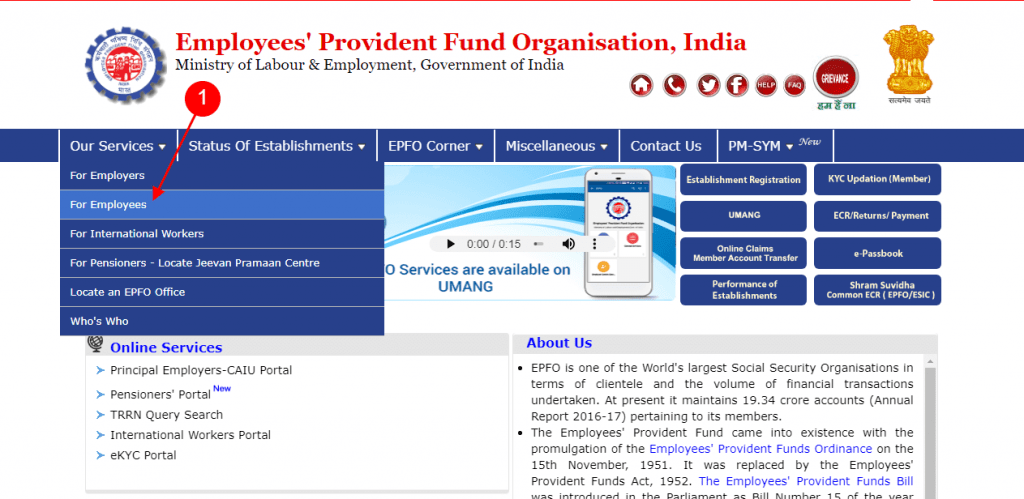

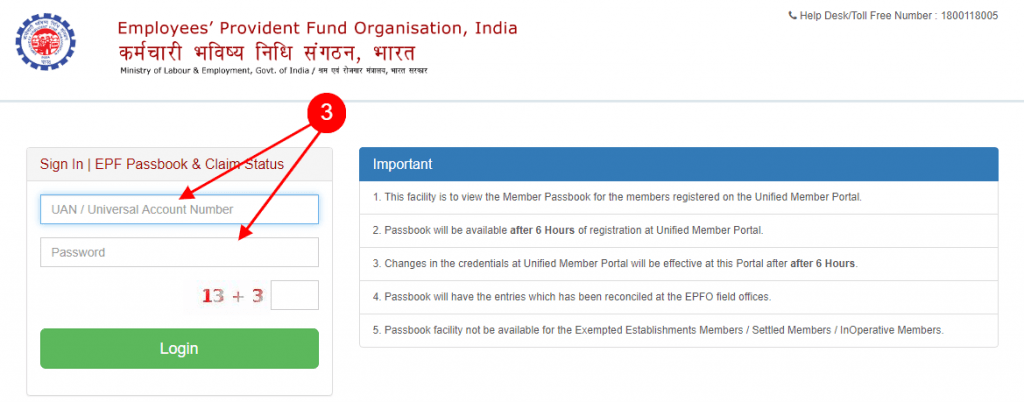

Step 1: Just to go to the EPFO portal https://www.epfindia.gov.in/ and login after registration. Click on the option ‘Our Services’ and select the option “for employees” which you will get under our services from the drop-down menu.

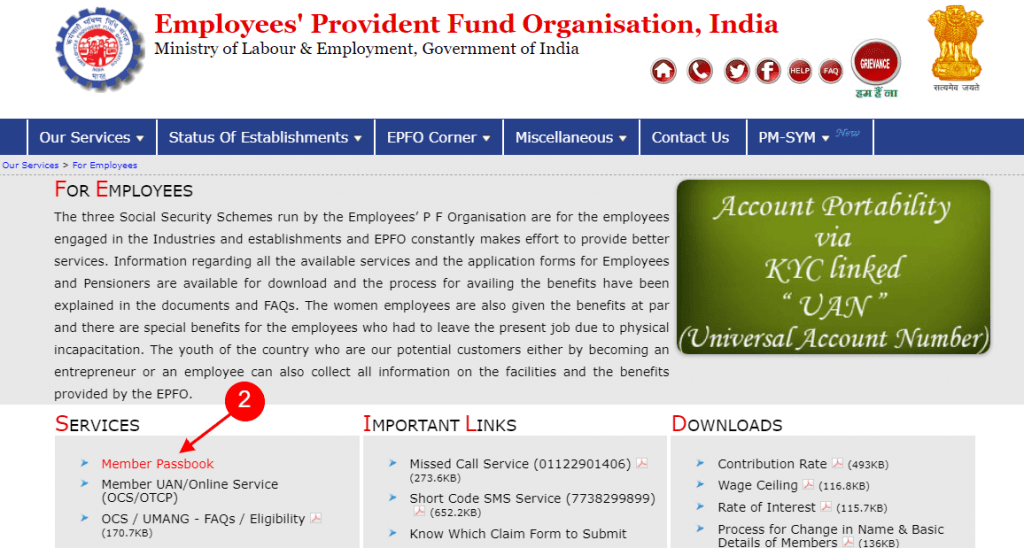

Step 2: Click on the option ‘Member passbook’

Step 3: Now, you will get a login page in which just enter your UAN number and password after that account will be activated.

Mode 2nd: Check through Sending an SMS

Things to know: One of the most important or essential processes for this is that your UAN number should be integrated with your KYC details.

In KYC details, things like PAN number, Aadhar number, bank account details included.

If any of this information is incomplete or wrong then, you cannot able to access the EPF balance through SMS.

After, the integration of your UAN number with the KYC details of yours, just follow the below-mentioned details:

Step 1: By your registered mobile number or any other mobile number send an SMS “EPFOHO UAN” to 7738299899.

Another requirement for this service is to check or select your preferred language so that you can communicate effectively.

Well, you must be thinking about how to choose the language so; you can do this by sending SMS with the first three characters of your preferred language.

For example: If you want to get the details in English just use the first three letters of the word as EPFOHO UAN ENG or for Hindi type EPFOHO UAN HIN, and for Marathi type in EPFOHO UAN MAR.

The Following service will be available in languages like Gujarati, Marathi, Kannada, Telugu, Tamil, Malayalam, English, Hindi, Punjabi, and Bengali.

Mode 3rd: Check Through Missed Call

The thing to know: Missed call is an option to EPF balance check. You can enquire about the detail of your mobile by giving a missed call from the registered mobile number.

This type of service will be available ahead of the addition of your UAN number as well as your KYC details.

In case you are not getting the result, just have words with your employer.

After the registration of your UAN numbers and full KYC details, just go through these steps:

Step 1: From your registered mobile number just give a missed call to 011-22901406.

Step 2: You will get a SMS with the PF details of your account including balance.

Mode 4th: Check Through Umang App

The thing to know: You must have your activated UAN number to check the balance of your EPF account through the Umang app.

Go to Download UMANG App from app stores. If you have an Android Mobile you need to download from Google Play Store and If you have an iPhone cellphone you can download it from the App Store.

Open Google Pay Store>Type UMANG on Search bar> Click on the Install button>Open Umang.

Download Umang App for Android or iOS

Follow The Steps in Umang App for Checking Balance:

Step 1: After Download Open Umang Application.

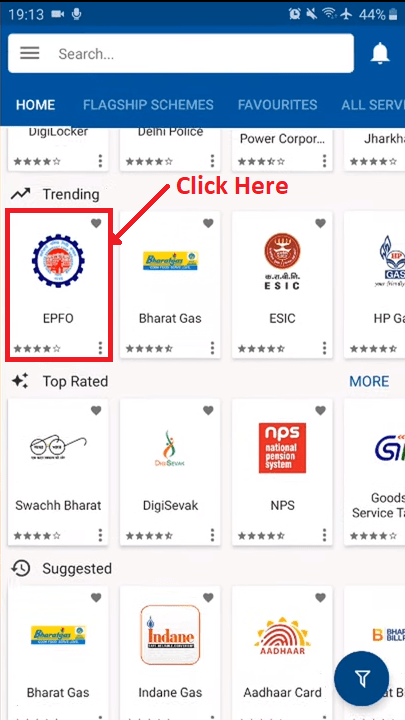

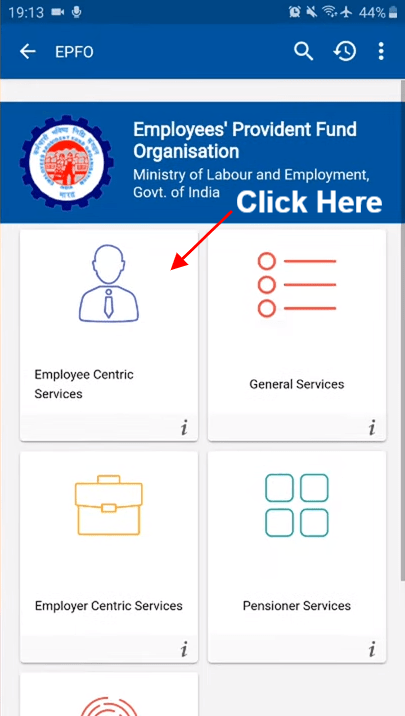

Step 2: Now, You can find EPFO option from UMANG.

Step 3: Now you can open the EPFO Tab. And EPFO having employee and employer-centric service, general service and pensioner services. Click on the ‘Employee centric Service’ and proceed further.

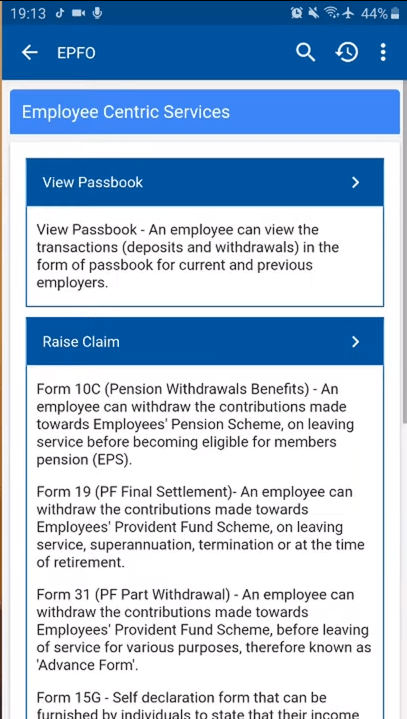

Step 4: You will get ‘Employee Centric Service‘ – You can view two services 1st – View Passbook, 2nd – Raise Claim. From View Passbook You can get your PF Balance/Details.

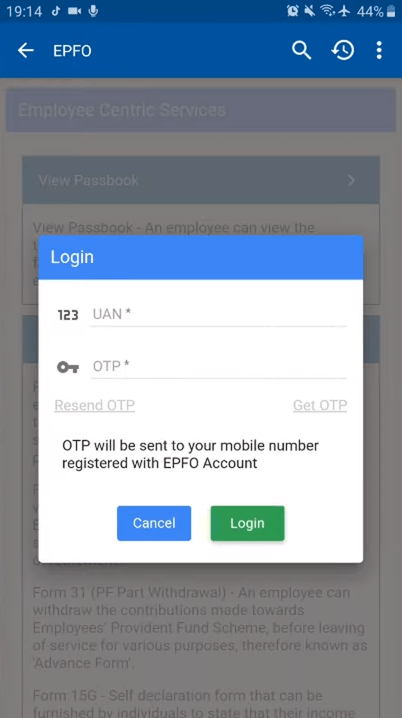

Step 5: Once you clicked on View Passbook tab it will ask for enter your UAN. After that click on ‘Get OTP’. You will recieve an OTP on your registered mobile number. And you need to enter OTP within 60 secends after you will get Login easily.

Step 6: After login you can see the list of all your EPF accounts that have created during employment with various employers. And if you want to check the balance and entries, Click on the employer-specific tab there you will get all employers’ details will be listed under the ‘passbook account details’ section.

By Click on view the details of deposits made in your EPF account during employment with that particular employer. Also, you can download the complete passbook pdf file.

In the passbook statement, you can check and verify your establishment number, member id, employer’s name, complete details of the employee;’s share, employer’s share, and pension contribution.

For better security purposes, If the app we are not using for some time, the services and your session get logout and after you need to login again to follow the same steps.

Summary: EPF is a good thing for anyone. I hope you have enough information about EPF.